Looks like the campaign is getting real. There’s been a lot of chatter online about how we can get lower property taxes.

The easiest way would be to lay people off, or cut services. If that’s what you’re interested in, there are other candidates.

If you’re interested in making Clinton a better place to live and work while still keeping property taxes reasonable, then we need to look at broadening our tax base, expanding the number of commercial and industrial properties so that the burden on residential property taxpayers isn’t so high.

I looked at this in 2018, when I chaired an ad hoc subcommittee on our property tax split. Working with town employees and members of the community, we came up with two recommendations:

- Reduce the town’s tax rate split at the rate of 2 percentage points a year until a single rate is achieved. Making an all-at-once leap to a single rate of $19.45 would result in a jarring increase of $883 to the average residential taxpayer. Chipping away at the split would spread out that impact to residential property owners over time, and demonstrate that the town is committed to improving the climate for businesses here.

- Continue to expand exemption programs as allowed by law. Publicize the availability of these programs, and the senior work program, to increase participation among those potentially affected by a tax increase.

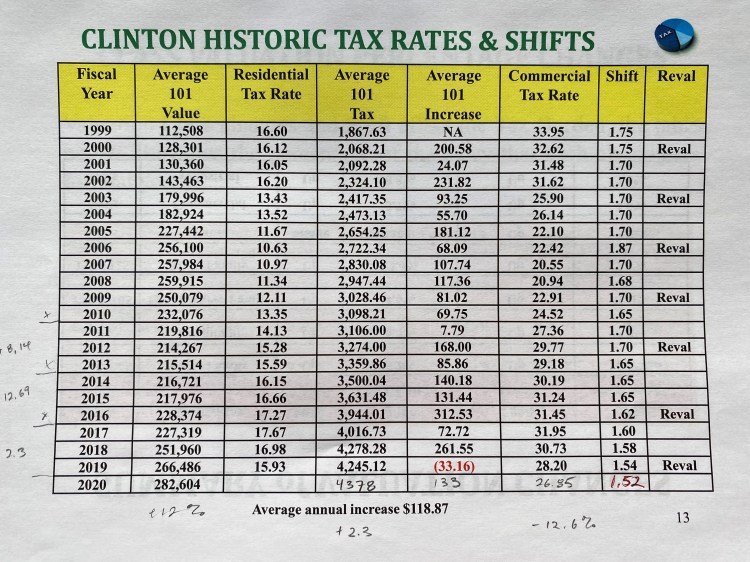

I’m proud to say our board adopted these recommendations (although, sadly, not unanimously). And you know what? Because of an expanded commercial, industrial and personal property assessment, residential property taxes (that’s the 101 classification) went down for the first time in more than 20 years.

Everyone wants more for less. Unfortunately, that’s not how life works. We can talk about lowering taxes by using cheap political tricks like maximizing the split (and alienating businesses, ultimately crippling us longterm) or waving some magic wand, or we can actually do the work and make it happen.

Here are the facts: There is one candidate in this race who has lowed your taxes, and who is committed to doing so in the long term. A vote for me on June 29 is a vote for broadening our tax base and giving REAL tax relief, not cheap lip service, to everyone in Clinton.

Would you like to read our committee’s report on how Clinton can see real residential property tax relief by broadening our tax base?

Check it out here: tax-classification-subcommittee-recommendations-11-15-18-final-1